salt tax limit repeal

Current law If sufficient generation-skipping transfer GST tax exemption is allocated to a trust it makes the trust perpetually GST-exempt. Meanwhile an extension of the 10000 limit on the federal deduction for state and local taxes paid was temporarily part of Senate Democrats agreement but removed in favor of a 1 excise tax on.

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

In the 2017 Tax Cuts and Jobs Act the federal government enacted a 10000 limit for joint and individual filers and a 5000 limit for married couples filing separately.

. An income tax is a tax imposed on. Version 102 3202009 updated California spreadsheet to correct the maximum income limit subject to SDIVPDI taxes. What it doesnt include is an easing of the 10000 limit on deducting state and local taxes from federal returns a cap put in place by Republicans in 2017 and which North Jersey Democrats.

Allow businesses to deduct 100 percent of short-lived investments for 5. Many of these same Democrats won their seats after launching aggressive attacks against Republicans for voting for the 2017 tax package that included a 10000 limit on the SALT deduction. 8-14 Also streaming this week.

Latest breaking news including politics crime and celebrity. Repeal of the cap on Social Security taxes. The county city and partners put an action plan into place to limit and identify other cases.

Enacted by the Tax Cuts and Jobs Act of 2017 the SALT cap spurred legislation in Connecticut New Jersey and New York that allowed residents to bypass the limit. Find stories updates and expert opinion. Limit to generation-skipping transfer tax exemption.

Learn how tax plays a key role in your business while the stakes continue to be high in regards to managing potential changes to US and global tax policy. 116th Congress Public Law 136 From the US. Hillary and Chelsea Clinton get Gutsy for Apple TV Plus and Tom Hanks plays Geppetto in Disney Plus Pinocchio.

Some of these states are suing to overturn the limit on the SALT deduction Who the expanded child tax credit helped. That is except for Justice Jennifer Brunner D-Ohio who seems. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys spending package.

After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion for FY 2020 thus resulting in a revenue savings. The Supreme Court of Ohio ordered all parties in State v. BruenGiven the import of the Bruen decision on both the state and federal level this seem eminently reasonable.

Many of these same Democrats won their seats after launching aggressive attacks against Republicans for voting for the 2017 tax package that included a 10000 limit on the SALT deduction. Set us as your home page and never miss the news that matters to you. Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law.

Latest-news Thailands most updated English news website thai news thailand news Bangkok thailand aecnewspaper english breaking news. Beer was difficult to transport and spoiled more easily than. Philpotts to file supplemental briefs addressing the impact on the case of the US Supreme Courts decision in NYSRPA v.

The 10000 limit on the amount of state and local taxes deductible from federal income was enacted in 2017 and sunsets after 2025 under current law. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage. Colorado to stop sales tax on diapers and menstrual products The state estimates the legislation will save Coloradans a combined 91 million annually.

Limit interest deductions to 30 percent of adjusted earnings for businesses with over 25 million in gross receipts. Insisted publicly that any version of Build Back Better repeal the SALT cap immediately or at least scale it back. Version 101 2222009 updated all spreadsheets to add user editable fields for specifying tax credits and parameters to request that.

Salt Lake County UT - The first two confirmed cases of COVID-19 were identified in the Mens Resource Center in South Salt Lake last week. There was much discussion of eliminating the maximum 10000 deduction for state. 2022 Tax Policy Outlook.

Opponents of the tax who thought it should only be used to finance wars wanted all records of the tax destroyed along with its repeal. Unchanged is the SALT state and local income tax deduction cap. Our experienced journalists want to glorify God in what we do.

The Whiskey Rebellion also known as the Whiskey Insurrection was a violent tax protest in the United States beginning in 1791 and ending in 1794 during the presidency of George WashingtonThe so-called whiskey tax was the first tax imposed on a domestic product by the newly formed federal government. The Tax Cuts and Jobs Act of 2017 greatly expanded the child tax credit CTC. Weeks of added procedures to prevent the spread of the virus held positive cases back as long as possible.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. The maximum value of the CTC doubled from 1000 to 2000 per child and it increased the income limits so that more taxpayers could qualify. Create a maximum tax rate of 25 percent on qualified pass-through business income accompanied by several anti-abuse rules-531.

Although this is a potential solution it should be carried out with a grain of salt to ensure that there is an even playing field for both entrepreneurs and. Cobra Kai Returns to Netflix The Handmaids Tale Is Back on Hulu and Paramount Plus Has the Final Season of The Good Fight - Whats Upstream for Sept. Government Publishing Office Page 134 STAT.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

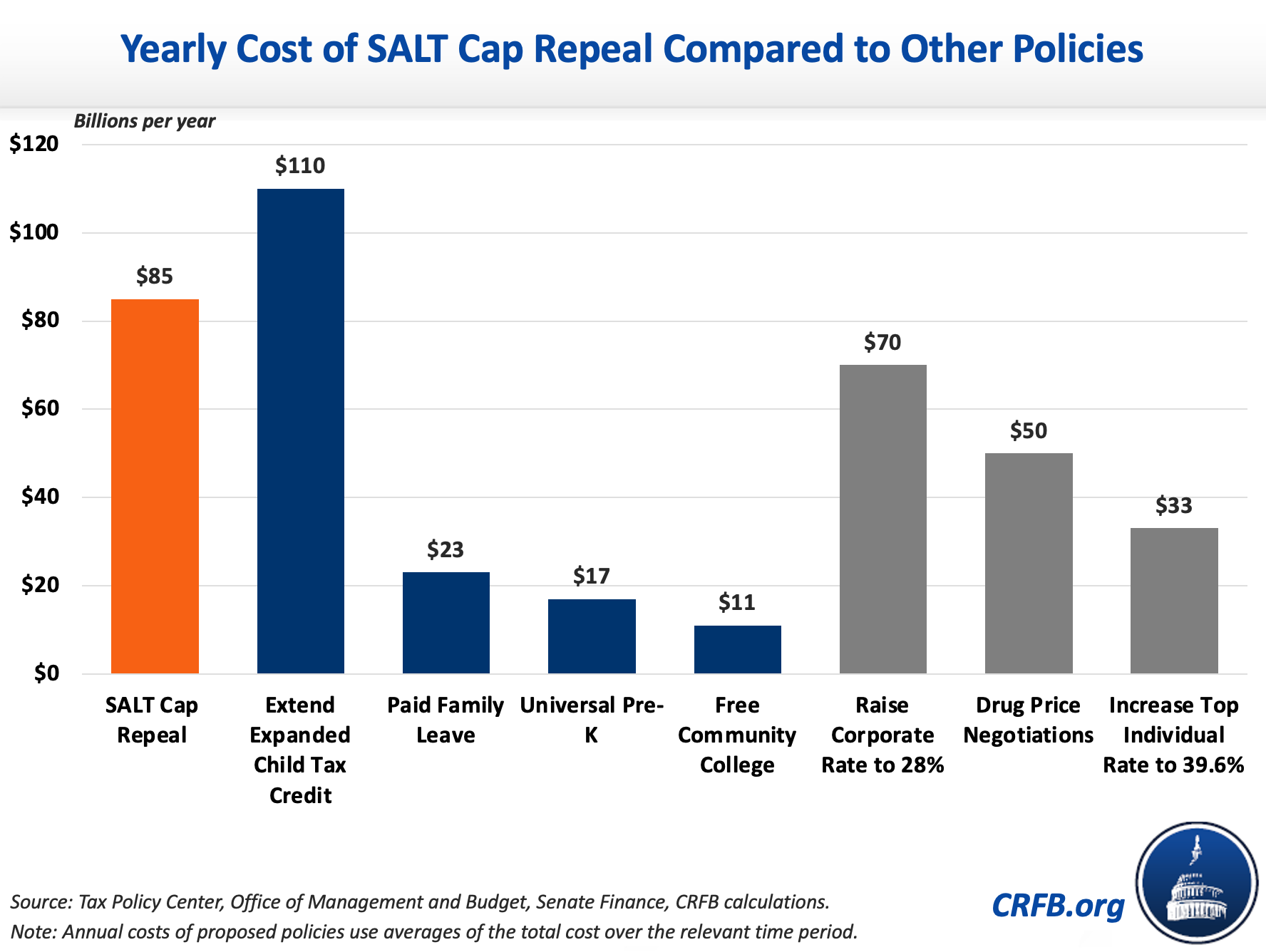

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

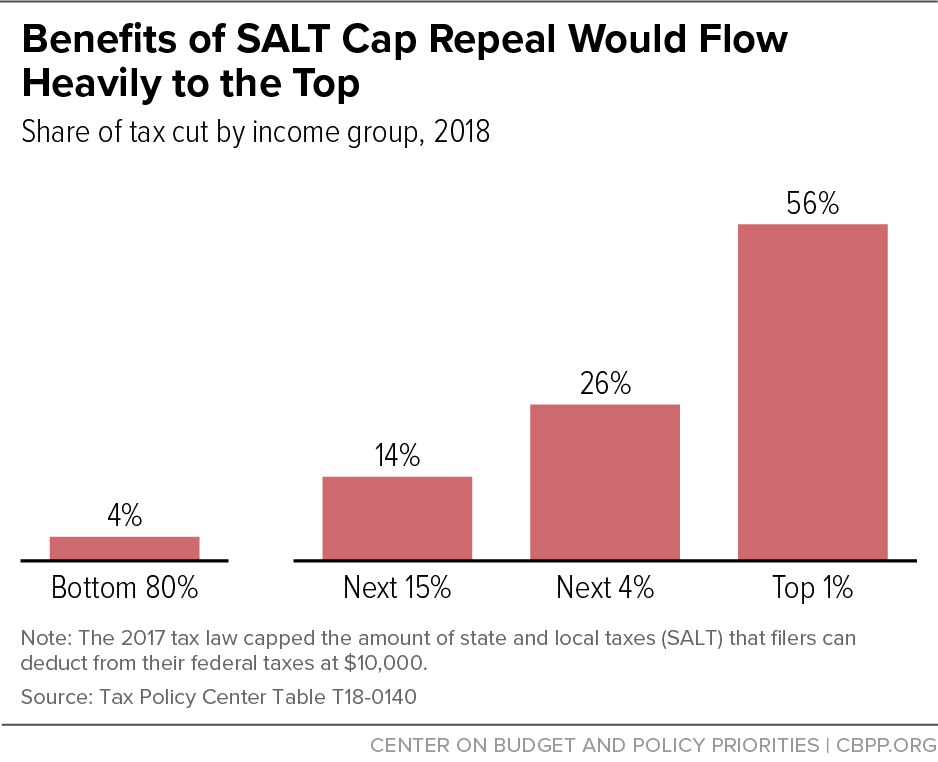

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Benefits Of Salt Cap Repeal Would Flow Heavily To The Top Center On Budget And Policy Priorities

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget