does draftkings send tax forms

Navigate to the DraftKings Tax ID form. The information provided by the player on the W-9 name social security number and address is used by DraftKings to populate IRS Forms W-2G andor 1099-Misc.

Learn more about the IRSs taxable reporting criteria for gambling winnings and IRS Form W-2G used to report income related to gambling.

. Fan Duel sent me mine via e-mail about a week ago. If you did not receive a W-2G form the IRS says taxpayers are still required to report all gambling income. Players who believe that funds held by or their accounts with draftkings inc.

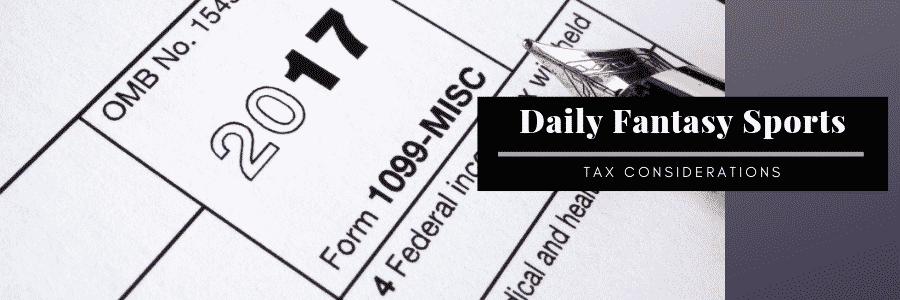

As sports begin a slow return daily fantasy sports companies could potentially owe millions more in taxes due to new government guidance. If you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS. Apparently Sports gambling is not considered.

On the Confirm Your W-9 Filing page below Name and mailing address tapclick the box next to. Draftkings 1099 form for 2021. Last updated May 31 2019 1103 PM I received a 1099-MISC form from DRAFTKINGS- an online sports gambling site.

This form will include all net. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. Never Got Tax Form From Fanduel Draftkings Please Help R Dfsports Nft And Dfs Cpa On Twitter Guccifrogsplash Highly Recommend You Do Not Go Off The 1099k Paypal.

Key tax dates for DraftKings -. Mile_High_Man 3 yr. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form.

Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. Only when you have a wager meeting. Forms 1099-MISC and Forms W-2G will become available.

If you have greater than 600 of net earnings during a calendar year you can expect to receive an IRS Form 1099-Misc from DraftKings no later than February 28th. Learn more about what is reported to the IRS. As sports begin a slow return daily fantasy sports companies could potentially owe millions more in taxes due to new government guidance.

Draftkings 1099 form for 2021. DraftKings customers in the United States arent taxed on their withdrawals. If your net earnings were 600 and are expecting a 1099 but have not received a hard copy of your form in the mail you can access this from the website both via desktop or mobile device for your tax record purposes.

Fantasy Sports Sportsbook and Casino DraftKings Marketplace. For legal sportsbooks a taxable event is considered a 600 net profit at 300 to 1 odds on a winning wager. In most states daily fantasy winnings of any amount are considered taxable income.

Players who believe that funds held by or their accounts with draftkings inc. How to dissolve pelvic adhesions without surgery. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both.

You should attach the schedule 1 form to your form 1040. This form is located under the Tax Information tab via the Avatar drop down at the top right hand corner of the webpage. Fantasy sports winnings of at least 600 are reported to the IRS.

If a player meets the reportable thresholds and. Its stated in the tax section on every app. 41nsk7bcouwizm draftkings tax form 1099 where to find it how to fill 41nsk7bcouwizm draftkings sportsbook nj promo code for 1 050.

Form W-2G from DraftKings just sharing We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the. Why am I being asked to fill out an IRS Form W-9 for DraftKings. Many people wonder if they have to pay taxes on their winnings.

6 rows Key tax dates for DraftKings - 2021. If you have a. Does Draftkings Provide Tax Forms.

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites. You can expect to receive your tax forms no. You should attach the schedule 1 form to your form 1040.

FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it.

Daily Fantasy Sports Tax Reporting

Daily Fantasy Sports Irs Memo Potentially Earth Shattering For Draftkings Fanduel Boston Business Journal

How To Deposit Withdraw Money In Draftkings Daily Fantasy Focus

Draftkings 1099 Form For 2021 R Dfsports

Worked From Home In 2021 City Tax Collectors Are Accepting Tax Refund Applications Cleveland Com

How To File Your Taxes If You Bet On Sports Explained

Fanduel And Draftkings Winnings By Canadian

Never Got Tax Form From Fanduel Draftkings Please Help R Dfsports

Draftkings Ceo Jason Robins Discusses Ny Tax Casual Players In Q A Sportico Com

How To Open A Draftkings Account Sign Up In 5 Quick Steps

Download The Draftkings Sportsbook App

How To File Your Dfs Top Shot Taxes Youtube

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Draftkings Sportsbook Review Why It S The Best Online Sportsbook

Refund Delays Stimulus Check Errors Foreshadow Rough Tax Season Bnn Bloomberg

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

Daily Fantasy Sports Tax Reporting

Dfs Taxes Will You Be Taxed For Winning At Fantasy Sports

Draftkings Take A Long Term Stand Dkng Stock Is Now A Strong Buy Seeking Alpha